Credit

Credit is essentially borrowed money. You, the borrower, enter into a contract with a lender (e.g., bank or credit union) in which you can use their money to buy something now and repay the funds at a designated later date.

Using & Managing Credit

Credit is used to obtain goods or services before paying for them, like: buying a car, taking out a mortgage, getting a lease on an apartment, etc. Recently, credit is being used in some states (not all) as part of a background check for employment.

Establishing credit for the first time can prove difficult if you have no prior credit history; some lenders are reluctant to issue credit to someone they don't know if they can trust or not. Learn more about credit and how to manage it wisely to accomplish your financial goals by completing Conscious Credit in the Borrow Course.

Learn More

Get a digital badge by completing modules in the Borrow Course. Click the image below for directions on how to enroll!

Credit Histories, Scores & Reports

Your credit history is a record of your ability to repay borrowed amounts per the terms of your credit agreements.

This record of your credit history is documented in a credit report. You can get a free copy of your credit report by visiting annualcreditreport.com.

Credit scores are a numerical value placed on your creditworthiness based on information in your credit report(s).

Want to learn more about credit scores, reports, and histories? Complete Credit Secrets Revealed in the Protect Course to learn what each means and why they matter to your financial future, including their impacts on leases, employment, access to financial tools, and more.

Learn More

Get a digital badge by completing modules in the Protect Course. Click the image below for directions on how to enroll!

Credit CARD Act of 2009

The Credit CARD Act of 2009 has many protections for consumers.

While you need to shop around for the best credit card for you, it's much easier now to get a credit card with fair and clear billing and interest rate calculations than it used to be. For example, the law limits when interest rates can be raised on credit cards, and it prohibits certain billing practices that were not favorable to consumers. You can learn more about the protections offered by the Credit CARD Act of 2009 in our Establish Healthy Credit course, but here are a few highlights to keep in mind:

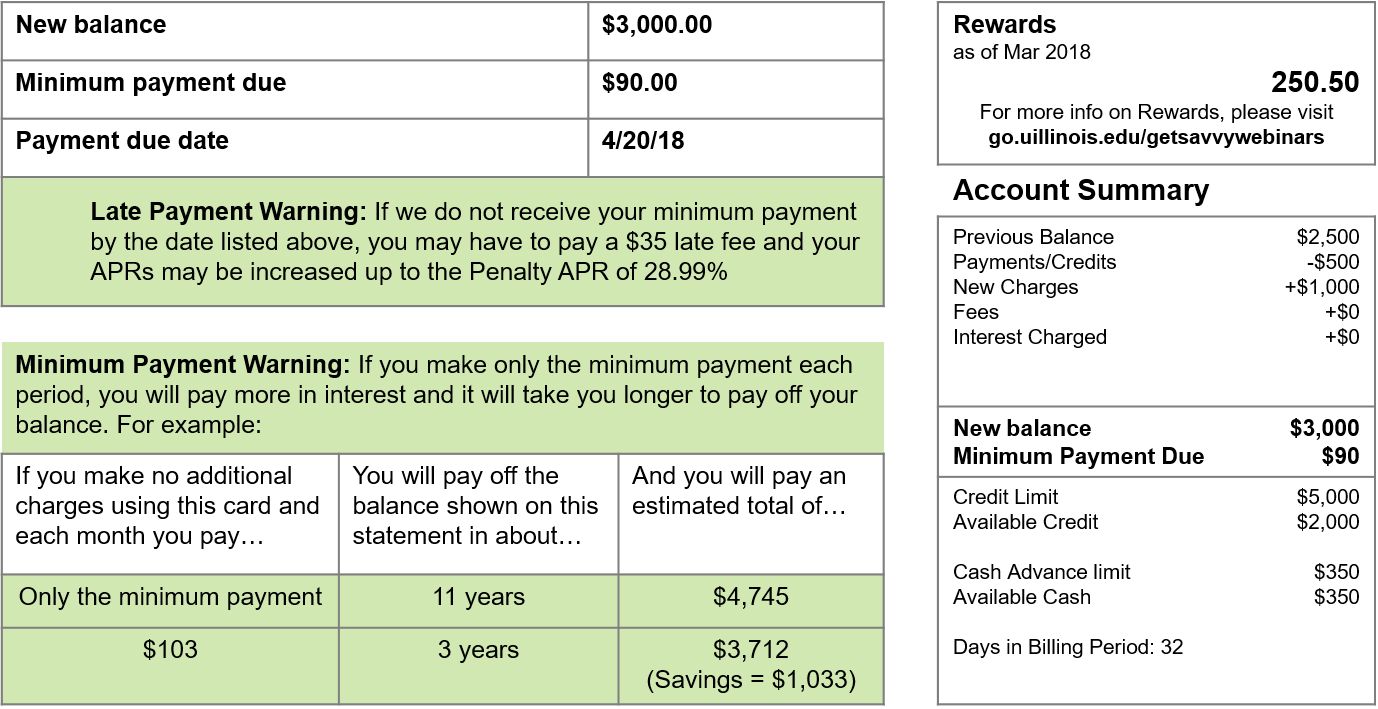

1. Pay More than Required

If you choose to pay the minimum on credit card balances, it will significantly increase the overall cost of your purchases and will take much longer to pay off the balance. However, if you pay the balance in full and on time each month, no interest will accrue, and you'll still be establishing on-time payment history.

For the example above, making a payment of $103 per month, just $13 more than the minimum $90 per month, would decrease your payoff timeline by 8 years and you would save over $1,000.

2. Beware of Interest Rate Changes

Some credit card companies will have low introductory rates to entice new borrowers. However, it's important to read the fine print to see when those introductory rates change or how your payment behaviors can impact changes to those rates.

On your credit card statement, there will likely be an interest charge calculation at the bottom where you can watch for any interest rate changes and see how much the interest is costing you on different types of transactions.

3. Know Your Credit Terms

There are several terms to know when it comes to credit. Make sure you understand the following terms so it can make reading your credit card statements and disclosures easier:

- Annual fee - a fee charged on credit card accounts once per year; remember, not all credit cards have an annual fee and the ones that do can vary significantly.

- Balance transfer - when you transfer a balance owed to one lender to another; balance transfers can help manage multiple accounts, but read the fine print to understand their costs

- Fixed rate - an interest rate that does not fluctuate throughout the year which is different from variable and introductory rates

- Grace period - a period of time when you don't have to pay interest; the Credit CARD Act of 2009 requires grace periods to last 21 days or more; often only applies to new purchases

- Introductory rate - also known as a teaser rate; an interest rate charged for a short period of time after the credit account is initially opened which expires to a higher, normal rate

- Variable rate - also known as a floating rate; an interest rate that can change over time and is usually associated with an index, or another rate.

Still have questions about credit terms or concepts? Email studentmoney@uillinois.edu.

4. Consider Opting-Out

There is a federal opt-out program to limit prescreened credit card solicitations, which can not only reduce temptation with pre-approved credit card offers, but can also help protect against potential identity theft.

You can opt-out for 5 years by calling 1-888-5-OPT-OUT (1-888-567-8688) or visit www.optoutprescreen.com. You can also opt out permanently by visiting the website, completing and signing the Permanent Opt-Out Election form, if you wish.

You can learn more about prescreened credit & insurance offers from the Federal Trade Commission.

5. Don't Confuse Debit with Credit

Even though debit & credit cards can look the same, it's important to know the differences between them and recognize the costs of confusing them for one another.

Obviously, it can be costly if you max out your credit card, or spend up to the limit, but you aren't usually able to spend over the limit on a credit card.

However, if you spend more than what's in the account attached to your debit card and have overdraft protection services turned on, the fees associated with each overdraft can quickly add up too. Pay close attention to the fees associated with any overdrafts or consider opting out of overdraft protection if you struggle with monitoring what's in your bank account.